What Does Financial Education Mean?

Wiki Article

Not known Facts About Financial Education

Table of ContentsFinancial Education for DummiesSome Known Details About Financial Education Excitement About Financial EducationIndicators on Financial Education You Need To KnowFinancial Education - An OverviewSome Known Details About Financial Education Some Ideas on Financial Education You Should KnowFinancial Education for BeginnersEverything about Financial Education

Without it, our economic choices as well as the activities we takeor do not takelack a solid foundation for success.Together, the populations they serve period a broad array of ages, earnings, as well as backgrounds. These educators witness first-hand the influence that financial literacyor the absence of financial literacycan have on a person's life.

Little Known Questions About Financial Education.

Our team is happy to be producing a new paradigm within greater education and learning by bringing the subject of cash out of the darkness. "Financial resources inherentlywhether or not it's extremely short-term in simply getting lunch for that day or long-term conserving for retirementhelp you achieve whatever your goals are.Every year since the TIAA Institute-GFLEC survey began, the ordinary percentage of inquiries responded to appropriately has increasedfrom 49% in 2017 to 52% in 2020. While there's even more job to be done to inform customers about their finances, Americans are relocating in the best instructions. The goal of economic proficiency is to develop a sensation of control over your funds while likewise making use of cash as a device to easily choose that construct better life satisfaction, according to a 2015 record by the Consumer Financial Protection Bureau (CFPB).

About Financial Education

Don't let the worry of delving into the economic globe, or a feeling that you're "just not good with cash," prevent you from boosting your monetary understanding. There are small actions you can take, and also resources that can help you in the process. To begin, make use of complimentary tools that may currently be available to you.Several financial institutions and Experian additionally supply free credit history tracking. You can make use of these devices to obtain an initial grasp of where your money is going as well as where you stand with your credit scores. Figure out whether the firm you benefit deals cost-free economic therapy or an employee monetary health care.

The 7-Minute Rule for Financial Education

With an excellent or outstanding credit report, you can certify for reduced rate of interest on car loans as well as credit report cards, bank card with appealing as well as money-saving perks, and also a variety of deals for economic products, which gives you the opportunity to pick the best deal. To boost debt, you require to know what variables contribute to your rating. Best Nursing Paper Writing Service.The last two years have actually been marked by the events stemmed from the COVID-19 pandemic. Such occasions are forming a. This new scenario is resulting in higher uncertainty in the economic setting, in the monetary markets as well as, undoubtedly, in our very own lives. Neither must we neglect that the crisis arising from the pandemic has tested the of representatives and family members in the.

Financial Education for Dummies

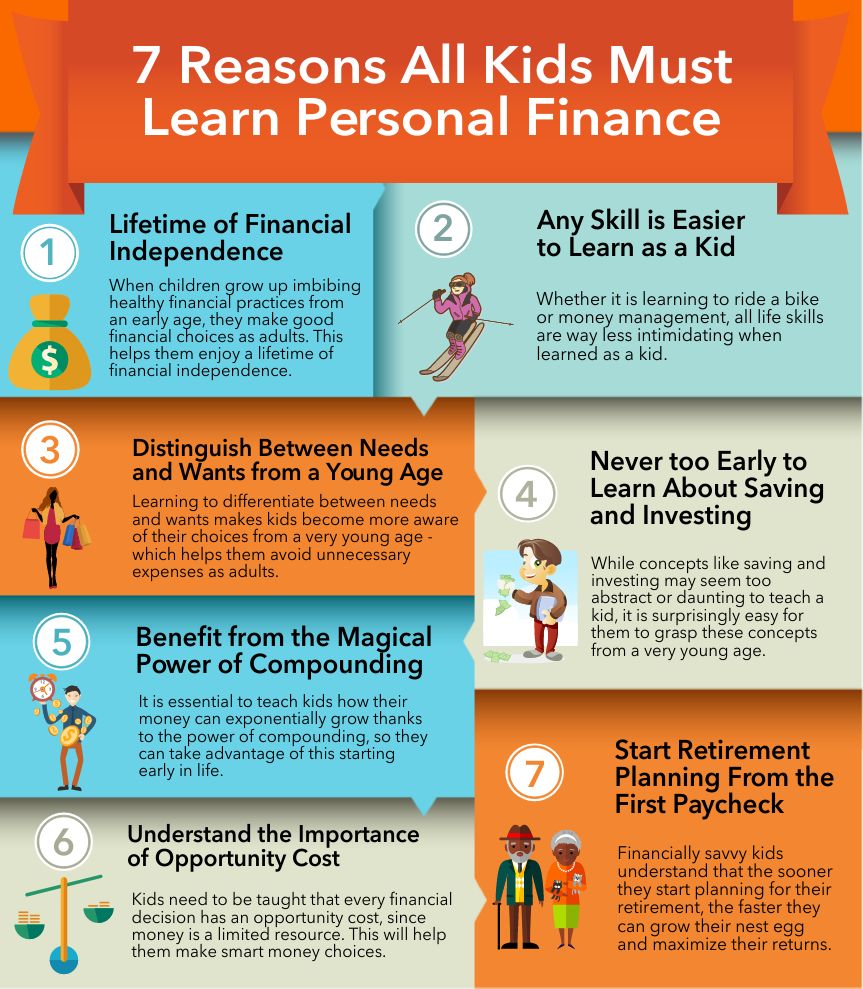

As we Full Report stated earlier, the pandemic has actually also increased making use of digital networks by people that have not constantly been digitally and also economically equipped. On top of that, there are additionally sections of the populace that are less knowledgeable about technological advancements and also are for that reason at. Including in this issue, following the pandemic we have click to read more actually likewise seen the decrease of physical branches, especially in backwoods.Among the best gifts that you, as a parent, can provide your youngsters is the cash talk. As well as much like with that other talk, tweens and teens aren't constantly receptive to what parents have to saywhether it's about consent or substance passion. As teenagers become much more independent and also assume concerning life after high school, it's simply as important for them to discover about monetary literacy as it is to do their very own washing.

All About Financial Education

Understanding how to make sound cash choices now will help offer teens the confidence to make better decisions tomorrow. Financial proficiency can be specified as "the ability to utilize expertise as well as abilities to manage monetary resources efficiently for a life time of monetary health." In other words: It's knowing how to conserve, expand, as well as safeguard your cash.As well as like any ability, the earlier you discover, the even more mastery you'll obtain. There's no far better location to talk concerning functional cash skills than in your home, so youngsters can ask questionsand make mistakesin a risk-free room. After all, nobody is extra curious about children' monetary futures than their moms and dads.

All about Financial Education

By showing youngsters concerning cash, you'll assist them learn exactly how to balance wants and needs without entering into financial obligation. Older teens may wish to take place a journey with buddies, but with also her response a little monetary literacy, they'll recognize that this is a "desire" they might need to spending plan and also conserve for.

9 Easy Facts About Financial Education Described

, instead of offering an automatic "no," aid them understand that it's not complimentary money.

A Biased View of Financial Education

Report this wiki page